Ergo, if you prefer a supplementary loan, make sure you are loans-clear of earlier borrowings

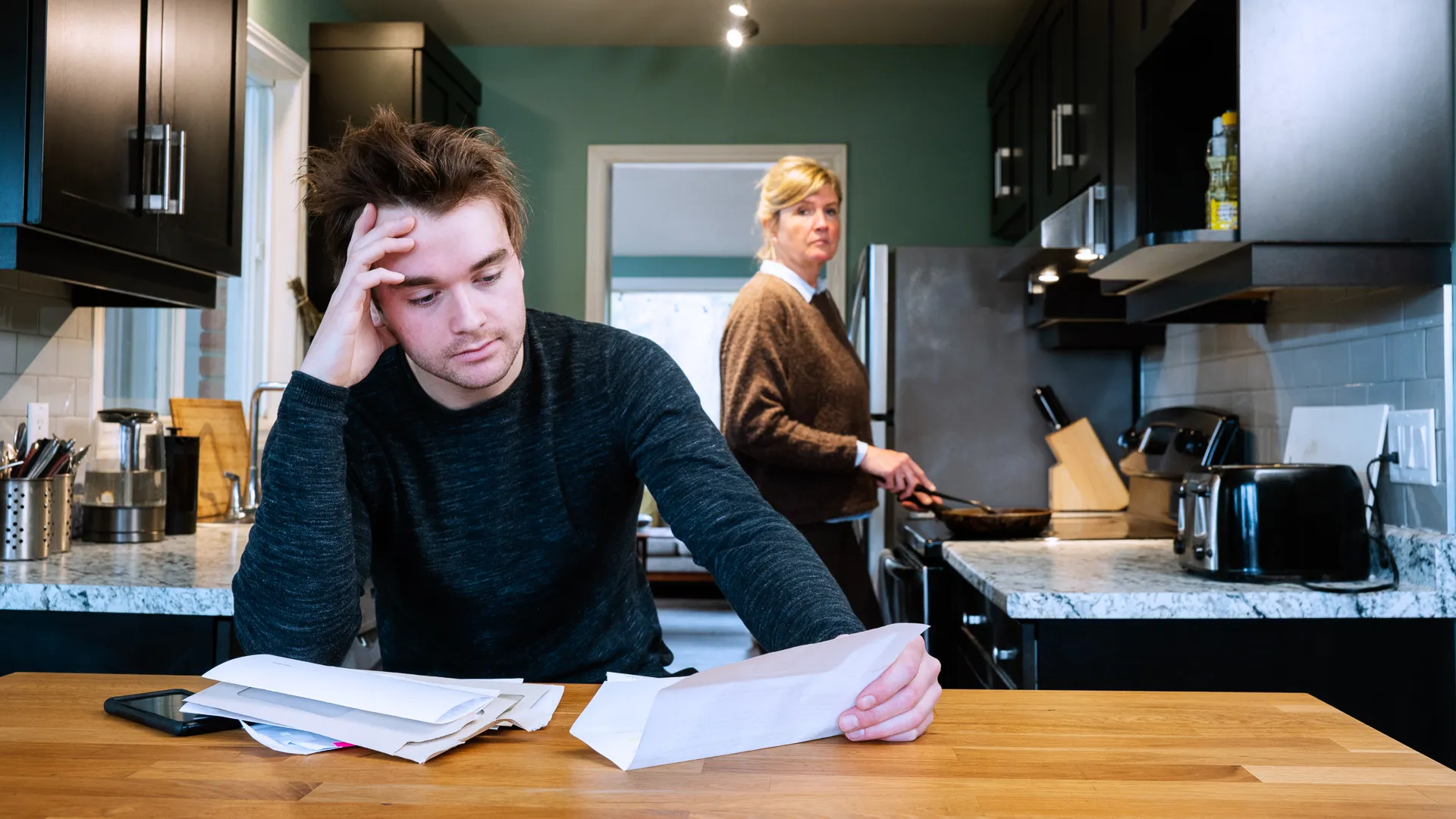

Today whenever we thought or discuss currency, finances, mortgages, assets, financial investments, or financing finance government automatically goes into the picture. Financial planning is a simple evaluation of cash, expenses, and you can offers. Be it a country, business, business, otherwise family, expertise and you will dealing with funds shall be exhausting. Proper economic planning not only secures your current economic situation but and assurances the next as well. Rigorous monetary believed leads to a medical monetary lives.

Having sufficient believe about funds, it’s possible to go their long-and-short-title goals conveniently. But periodically a guy might require extra loans. The requirement from money can also be a surprise inside your lives. There are many available options in the business through which you to definitely will get fulfil their/this lady requirement of funds and you may bringing a personal loan is but one of these. Appropriate financial thought with a continuing loan is very essential as life revolve around financing.

Not only will this help you easily manage your expenditures, coupons, and assets and repay the debt timely in the place of additional interest and you can charge. Listed here are given several effortless info that may help you to handle your own money easily although you have an ongoing loan:

Pursuing the above-provided information will allow you to would profit in a manner to manage quick money, keep costs down, and sustain proper credit history

- Would your debt-to-earnings Ratio

When you submit an application for a personal loan, the bank otherwise monetary institution directly checks your debt-to-income proportion. To check your own expenses skill, the business have a tendency to separate all your valuable monthly debt costs by the month-to-month earnings. If at all possible, their front-stop ratio really should not be more twenty-eight per cent, while the straight back-avoid proportion would be 36 % otherwise smaller also all your expenditures. Through this, your paying back skill is actually in hopes. To own keeping a decreased loans-to-income ratio, you really need to take control of your expenses. If your expenditures try organized, it will be possible on exactly how to pay all your own due instalments timely.

Adopting the over-considering tips will assist you to carry out money in a sense to help you handle prompt payments, keep your charges down, and sustain a healthier credit history

- Repaying Highest-costs Expenses

Prior highest-prices costs could be the genuine reason economic think fails with new lingering mortgage. You should to blow most of the particularly earlier high-prices expense Houston installment loan with savings account just before opting for a unique loan. Mortgage buildup does not only cause stressful financial things but also can do a huge state if not addressed safely.

Adopting the a lot more than-considering information will help you to carry out funds in a sense so you’re able to manage prompt costs, reduce costs, and keep proper credit rating

- Increase Deals owing to Quick Installment Arrangements

Already, there is a large number of on the web websites otherwise websites that offer your different types of installment modules nevertheless would be to choose simply for for example an agenda that’ll give you maximum benefit. For folks who take control of your funds really, you could pay off the private amount borrowed far sooner than the new arranged time. This will also help save you a little extra count which will has already been charged as an appeal. Payment out of finance in advance of date including speeds up protecting and you may costs element.

Following more than-given information allows you to manage cash in a way so you’re able to manage timely money, keep costs down, and sustain a wholesome credit score

- Be mindful of Earnings, Savings, and you can Costs

Monetary monitoring is an ongoing processes. Using in some places can merely get across your financial allowance limit even before very long. Considering their expenses is the better way of preventing way too many disbursement. It has been advised to jot down all your valuable costs ahead of time so that you will get focus on something depending on the requirements, specifically if you enjoys a continuous personal bank loan. This is extremely of good use when you’re a small tight with the profit in every week and then have to invest any bills to your an unexpected basis.

Definitely strictly realize anything you has organized. Overseeing ought to be done in the normal menstruation of time to ensure if there is one change in your earnings otherwise expenditures, it may be handled easily with no hustle. You might use some other mobile otherwise computer applications locate and you can inspect your revenue and you will expenses together with your reduced costs and you will savings.

Pursuing the significantly more than-offered tips allows you to do cash in a manner to deal with quick payments, reduce costs, and keep maintaining proper credit history

- Would Quick Money

You should be really controlled if you have to spend out of your ongoing financing as fast as possible. Besides timely fees will assist you to improve your monetary condition it also boost your offers. And you can rescuing a lot more about usually help the personal loan cost ability and that way you could potentially control your funds really while you are paying down any dues.

A personal bank loan was unsecured credit. Although the lender/NBFC will not ask for security, it is crucial to spend the money for EMIs timely.