You may have to operate quickly to stop missing a cost and you will defaulting to your a personal bank loan. With respect to the problem, you could look into a way to treat most other expenses, re-finance your debt otherwise score help from the financial otherwise a beneficial borrowing from the bank therapist.

On this page:

- Whenever Is actually a consumer loan within the Default?

- How to avoid Defaulting to the an unsecured loan

- What are the Outcomes away from Maybe not Settling Your loan?

When you are not able to afford the expenses and you will imagine you could miss your next personal loan percentage, you ought to evaluate the choices prior to it is far too late. Falling about and ultimately defaulting to the mortgage can result in even more charge and you may harm your own credit for years. You will be capable of getting assist otherwise steer clear of the later fee for individuals who operate easily.

Whenever Are a consumer loan when you look at the Standard?

Your loan get officially be in default when you skip a fees, because the you are failing continually to follow up toward regards to new loan contract you finalized. Yet not, of many unsecured loans (and other user finance) provides a grace several months in advance of a cost is actually claimed to the credit bureaus since later.

Even with the fresh new grace months has passed, creditors will get think about your mortgage outstanding to own a period of time in advance of saying they into the default. Just how long the loan is considered outstanding depends on the financial institution, however, constantly shortly after three to six days, it could be considered in the standard.

How to avoid Defaulting on a consumer loan

There are many means you happen to be able to stop lost your mortgage commission, nevertheless most effective way is dependent on your position.

Including, if you fail to manage a costs so it month on account of a one-time drawback, dipping towards an urgent situation fund or briefly counting on a credit credit will make feel. But when you have a much trouble having months in the future, you may want to maintain your disaster money to own extremely important expenditures (particularly houses and you will eating) and you will think other choices otherwise version of recommendations.

Remark Your budget and you will Scale back

As much as possible reduce costs, you’re capable release money you might set toward the loan payments. Comment your allowance otherwise latest bank and you can mastercard statements in order to get a sense of just how much you might be expenses and you will where the cash is heading. When you find yourself cutting back is not fun, to prevent a later part of the fee can save you currency, and you will keeping your a good credit score can present you with a lot more economic selection later on.

Contact your Bank

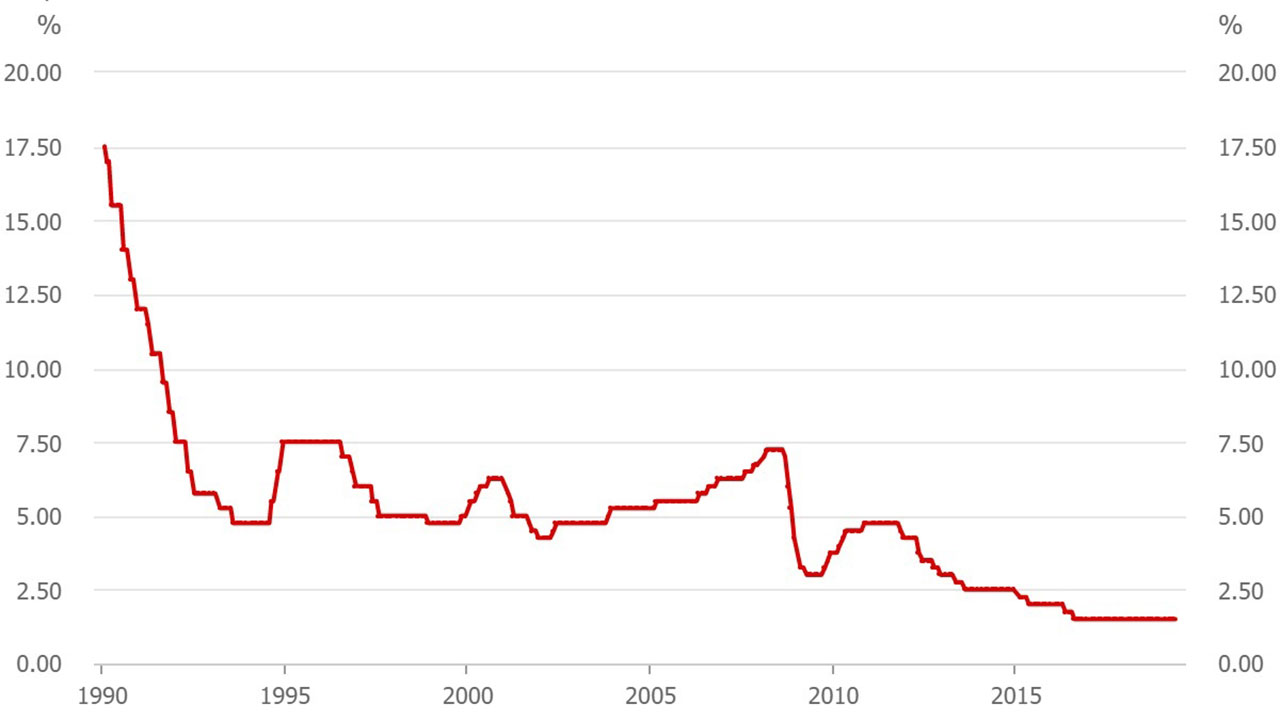

Whenever there is no go place in your urgent link finances or you might be dealing that have an emergency state, such a missing out on work or unanticipated medical costs, get in touch with the financial immediately. The organization s, such as a briefly all the way down rate of interest or monthly payment, otherwise a temporary pause in your payments.

Re-finance or Consolidate the loan

When you yourself have good credit, you’ll be able to qualify for a separate loan you should use to help you re-finance or combine costs. Your monthly premiums could fall off if your this new mortgage has actually an excellent down interest or stretched cost identity. If you are moving obligations from just one bank to some other isn’t really a lasting long-term approach, it might make you adequate respiration area to capture upon your costs and prevent defaulting on your own loan.

Play with a balance Transfer Bank card

Just like using a separate loan, certain handmade cards offer a marketing 0% apr (APR) on balance transfers. A number of notes together with allow you to import a balance on the family savings, and you can following use the money to invest off or off the unsecured loan. It can be easier to make mastercard costs and you will lower your debt given that credit card isn’t accruing appeal.