Nowadays, alternative and online loan providers, such Kabbage, was growing. This is mostly considering the feature out-of option lenders so you can utilize technology and gives quicker accessible small business funds. They also have flexible qualifications requirements, particularly in terms of fico scores and you may yearly cash flows.

In this book, we will falter the fresh Kabbage small business funds to assist you determine if the loaning options are perfect for your company. DoNotPay makes it possible to raise your probability of mortgage acceptance by the doing a compact and you can persuading financing consult page to you personally.

What type of Small business Loans Do Kabbage Offer?

Kabbage provides small business fund in the form of traces of credit, which happen to be funded by the American Show Federal Lender.

With a personal line of credit, your company is assigned a loan maximum as you are able to mark regarding when you need the money. This means you can receive people amount borrowed any time, provided that that you don’t go beyond the borrowing limit.

- Covered line of credit-Requires one put a valuable asset as the collateral in the event you neglect to afford the loan

- Unsecured personal line of credit-Doesn’t need guarantee on how best to safer that loan

- Rotating credit line-Works identical to playing cards. Every buy numbers are deducted out of your accepted credit limit, whenever you are costs fix they

- Non-revolving personal line of credit-Makes you use shortly after, therefore cannot make use of the restriction after you pay off the fresh loan

Kabbage brings merely revolving lines of credit getting smaller businesses. This will make it you can to make use of the cash for various purposes, particularly:

- Resource every single day functional costs

- Since the will cost you of carrying out a corporate otherwise typical startup costs

Kabbage Small company Finance Qualification Standards

As with any different kind from small company financing, you have got to see the requirements so you’re able to be eligible for Kabbage resource. Your online business should be working for around 12 consecutive days and possess a valid providers family savings. The organization should have seen an american Display team credit for around a few months or even to was in fact approved to possess Kabbage capital in earlier times.

Regards to Kabbage Business Money

This new regards to Kabbage money, such as for instance rates and you may loan wide variety, are determined circumstances by circumstances-however the interest levels are often greater than those of most other financial support potential, for example SBA financing.

- Monetary data regarding the membership your hook in your software

- Monthly company money

- Time in company

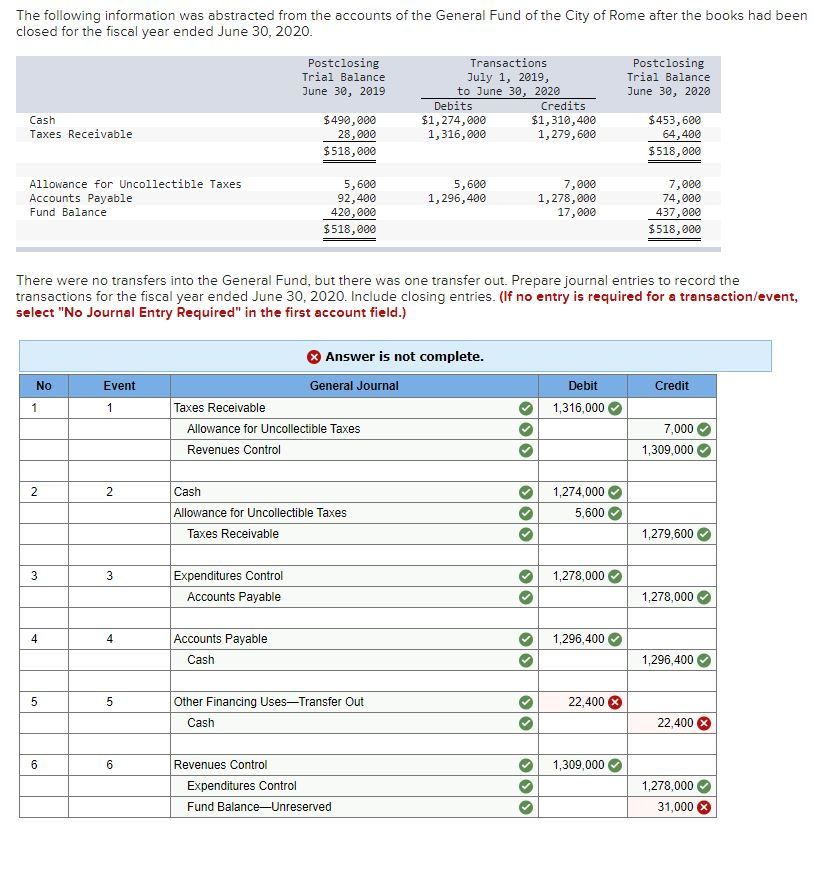

After you use, Kabbage will tell your of one’s conditions they get a hold of appropriate for your business. The latest desk lower than will bring a list of plain old Kabbage terms and conditions:

Kabbage Home business Application for the loan Procedure

Kabbage financing programs are submitted online within a few minutes. To get that loan, you ought to finish the on the internet application on their site. The mandatory information is sold with:

You ought to along with allow Kabbage and also make a challenging query into your personal and business credit file. Whether your loan application is eligible, the amount of money is delivered to your bank account, that fill up to three working days, according to your own lender.

A beneficial Kabbage line of credit is not permanent. It is susceptible to periodic critiques and will be suspended or got rid of if you need to.

And make Costs to own a beneficial Kabbage Home business Loan

The initial bank account you make certain on your own software techniques is regarded as much of your account. It account provides to have placing financing and you can withdrawing repayments. When you undertake the mortgage arrangement, your enable Kabbage to help you automatically withdraw money from the primary account for mortgage repayments. This is done automatically to the month-to-month payment dates. You can check this new deadline and you will matter on Resource Review part of your Kabbage membership.

Boost your Odds of Getting a loan that with DoNotPay

Step one into the securing small business money is finding out how they work. Up coming, you ought to make sure your app documents reflect exactly what lenders find.

One of the most very important files are that loan request page. It says to the lender concisely as to why they need to fund their small business. We can make it easier to write a persuasive mortgage request letter contained in this one minute. Realize these types of basic steps to get your letter instantly:

In case the search for an informed small business financing does not prevent having Kabbage, you can look at options to pay for your financial budget, such as for example:

We are able to help you find the newest available online lenders prompt and you will stress-100 % free. Discover DoNotPay and locate the Come across Web based business Loan Bank device making it happens.

Include Your own Brand and Make Believe With your Pages!

One of the most tricky regions of every single business is strengthening a trustworthy reference to the shoppers and you will keeping a strong reputation. This is why it is crucial to safeguard your business name, representation, and you will motto legitimately from the registering it a signature. DoNotPay is here so you’re able to do this problems-totally free with this Trademark Registration device. Need assistance checking having signature violations once you register? You don’t need in order to be concerned while we features a tool which can help you with that too!

Now that your own signature are out of the way, you should know complying having studies protection criteria for taking care of your own users’ privacy. You certainly can do thus that with all of our Confidentiality Shield Care about-Certification tool.

Are you presently writing on phony negative on line critiques which might be injuring your online business? DoNotPay helps you by the evaluating the reviews and you will reporting them up until they are removed!

Go out Are Money, and DoNotPay Will save you One another!

DoNotPay also offers many go out-preserving enjoys that can be used if you not feel eg referring https://availableloan.net/loans/credit-union-loans/ to business-related challenges yourself. We could make it easier to:

How would you like let writing about members that do n’t need to cover the services you provide? Have fun with DoNotPay’s Infraction away from Price unit to send a page regarding request in a matter of moments! Unclear what direction to go having unfair chargeback needs? We could make it easier to through good chargeback rebuttal file getting that post into percentage processor chip.