Willing to apply?

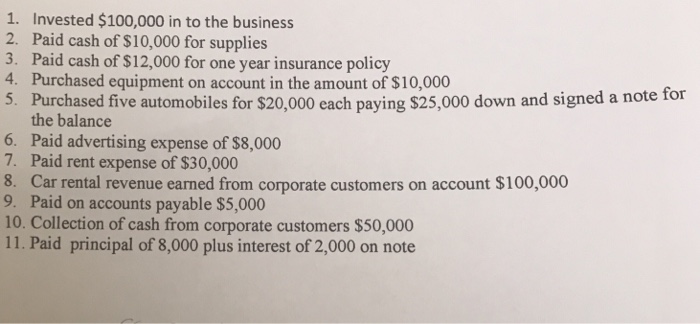

No matter whether the debt try secure otherwise unsecured, lenders usually evaluate the continual monthly premiums for the terrible month-to-month earnings, otherwise the debt-to-income proportion (DTI). It is an essential demands which can make-or-break the probability from home loan approval. So, stay away from taking out fully almost every other money or personal lines of credit otherwise about, put them off up to once financial approval.

Avoid which by simply making higher dumps (generally speaking money that will not are from payroll) about two months before applying having a home loan. And always be certain that discover a magazine walk, to let their financial origin where in fact the finance emerged regarding.

On Western Investment, we ask that borrowers do not allow people borrowing from the bank concerns otherwise unlock people brand new membership when you look at the acceptance processes. The reason being they transform the credit results and loans rates since there are new bills getting extra. And, people improvement in fico scores otherwise record is also hurt your mortgage speed. This can include co-signing some other people’s borrowing, the same as obtaining the borrowing in brand new attention of your lender.

Don’t close account possibly. Closing a free account minimises your offered borrowing from the bank. For example, when you yourself have borrowing restrictions totaling $ten,100, and you can balance of $2,100, the proportion are 20%. For people who after that personal an abandoned bank card having a threshold out-of $6,100, you just raised their proportion so you’re able to fifty% – that will be an adverse situation so you can a mortgage lender.

So, consumers who change perform in the middle of the procedure manage even more underwriting conditions and therefore wind up slowing down the loan approval procedure. When you’re considering switching efforts and want to meet the requirements having a mortgage loan in the future, consult with a mortgage elite to see if work circulate tend to adversely apply to what you can do becoming entitled to a mortgage.

Prior to making one huge dive toward to invest in you to definitely fantasy family, below are a few more info which can be particular so you’re able to reducing can cost you when selecting an alternate domestic.

Give software are designed to assist homebuyers increase money having down money. Licensed consumers haven’t any obligations to invest back granted funds, should they meet program payday loans Graham standards.

Make a great deal to be considered? You are in luck. Gives are only one way to let homeowners which have upfront will set you back. By , you’ll find already over 2,five hundred productive downpayment recommendations software in the united states. So you shouldn’t be scared to look for county otherwise bodies recommendations. There might be a choice that fits your circumstances really well.

Have fun with skilled currency

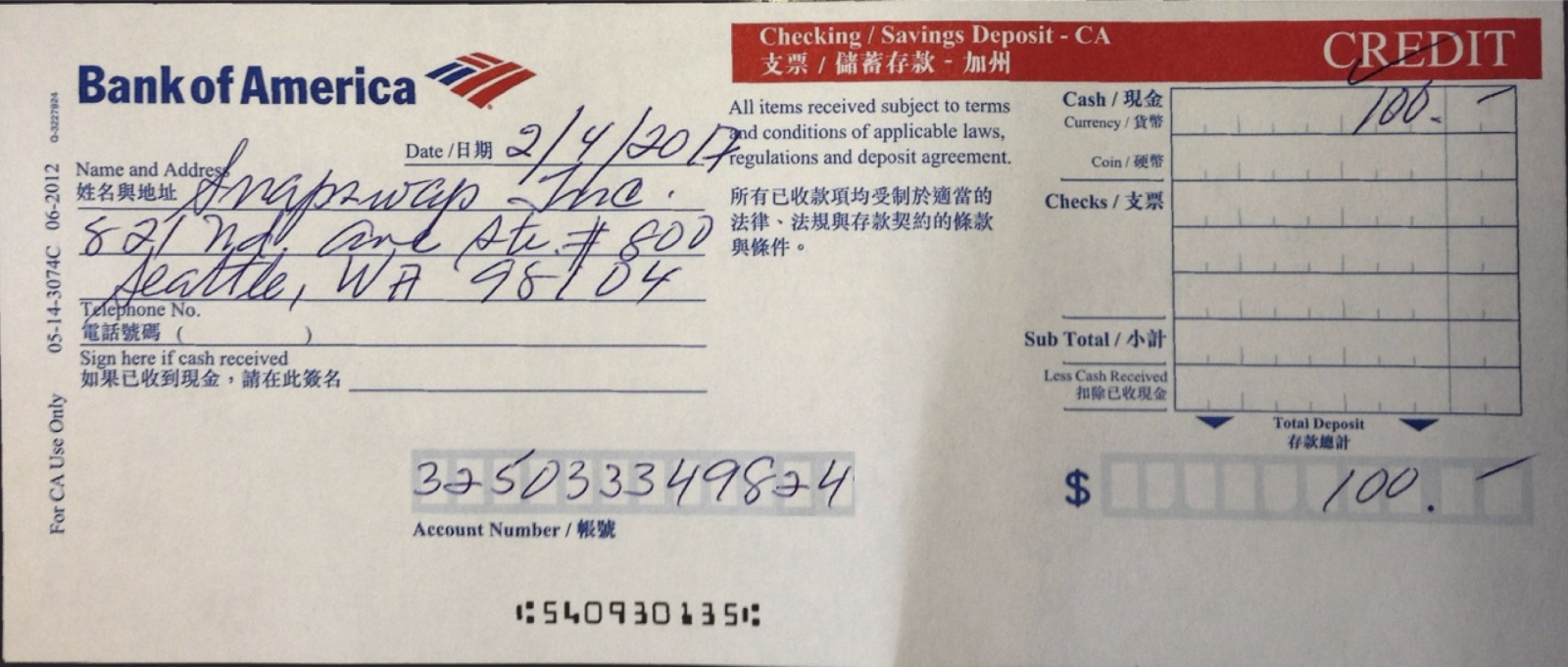

The bigger your own downpayment, the less you have to finance. When you yourself have members of the family who’re prepared to “gift” your currency which may be applied towards a downpayment, employ! Extent you can take on may differ from the loan program, and it also needs a letter that documents money are a good provide and not a loan. Your bank will get inquire observe a lender report confirming one the new donor provides the money to help you present to you personally, a duplicate away from a canceled glance at produced off to your, otherwise paperwork appearing an electronic digital transfer within donor’s account and your personal.

To have a full selection of regulations, something special page analogy, and program requirements, make sure to here are a few our very own down-payment gift blog post.

Doing your research to take on all of the mortgage solutions is good strategy to assist cut household can cost you. Requiring merely 3.5% as a result of go into a home, this new FHA financing program brings bodies backing towards the money underwritten by the finance companies. Regardless if your payment per month will get complete feel high, this may add up on precisely how to think a keen FHA mortgage to invest minimal money initial right after which save money later on.

If you reside in Tx, examine Texas Homes and you can Fund Authority’s CHFA loan, that can allow you to get to the a property to own as low as $step one,one hundred thousand down. Even better, when you are active obligations military or a veteran, the fresh Virtual assistant mortgage includes no home loan insurance no called for advance payment to view a property.

Remember; there are more mortgage programs available to you. Our very own educated paycheck-based home loan consultants can help with determining and this financing is the greatest to suit your financial situation. They’re able to actually personalize financing program, so it’s ideal complement your position.

Negotiate closing costs

Closing costs generally work on anywhere between 2% and 5% of the loan amount. With regards to the a home climate close by, you have the opportunity to get a fraction of your closure will set you back shielded for many who negotiate with the domestic seller. Issues such as for example the length of time the house has been in the market while the business (typically) are having difficulties are perfect reasons to negotiate closing cost possibilities.

Merely make sure you remember the bottom line: get ready and you will help save what you are able in the process. The borrowed funds procedure will likely be relatively quick if you follow your lender’s recommendations and you are clearly happy to agree to and come up with one to dream (home) become a reality.